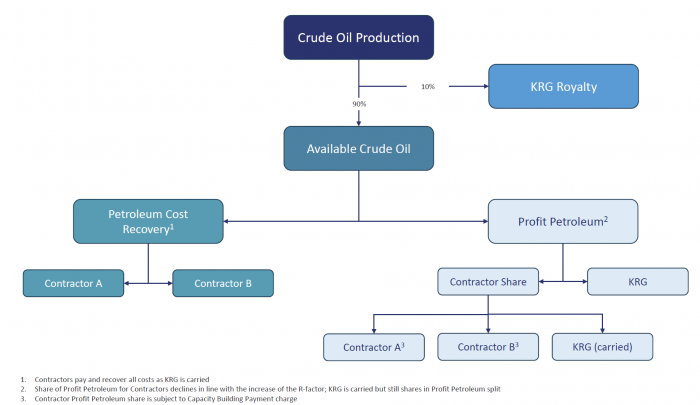

In a production sharing contract (“PSC”), the host country’s government awards to an oil company (or group of companies, typically called the Contractor) the rights to explore in a specified area and, following discovery of hydrocarbons in the area, the right to produce the discovered resources. The Contractor initially bears the risk of finding hydrocarbons and explores, develops and ultimately produces the field in accordance with the terms of the PSC. When successful, the Contractor is permitted to use the money from produced oil sales, after payment of royalties owed to the host government, to recover its capital and operational expenditures, known as “cost oil”. The remaining money is known as “profit oil” and is split between the government and the Contractor. In some PSCs, changes in international oil prices or in the field’s production rate affect the company’s share of production.

The contract term frequently includes an Exploration Period and a Development Period, each with a timeframe and work commitments. The timeframes can often be extended depending on the circumstances and approval of the host government. In the event of a commercial discovery and subsequent delineation of the relevant field, the term for development and production can, for example, be 20 or more years with additional extensions possible.

Often in PSCs, the acreage included in the contract area and not converted into a producing field may be required to be relinquished at pre-agreed rates that can range from 25%-100% at the end of certain time periods.

The calculation of the oil revenue flow can be quite complicated – royalties, cost oil recovery, profit oil, total profit oil (sharing based on “R Factor”, which is a ratio of cumulative revenues to cumulative costs) and production-based bonuses payable to the host government (sometimes called a “capacity building bonus”).

An outline of the PSC revenue flow is shown below.